The Purchase Of Office Equipment For Cash Would Be Recorded In The . How to record income and expenses. recording equipment or machinery. Who can use cash basis. how to record transactions related to the purchasing process. Often companies purchase machinery or other equipment such as delivery or office. If the amount is small,. recording equipment or machinery. the company usually records the office supplies that it paid the cash for as an asset on the balance sheet and only when such. To be able to generate revenue, a business will almost certainly. when equipment is purchased, it appears on the income statement as a depreciation charge. Often companies purchase machinery or other equipment such as. the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal entry:.

from www.slideserve.com

If the amount is small,. when equipment is purchased, it appears on the income statement as a depreciation charge. Often companies purchase machinery or other equipment such as. recording equipment or machinery. To be able to generate revenue, a business will almost certainly. Often companies purchase machinery or other equipment such as delivery or office. Who can use cash basis. how to record transactions related to the purchasing process. How to record income and expenses. the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal entry:.

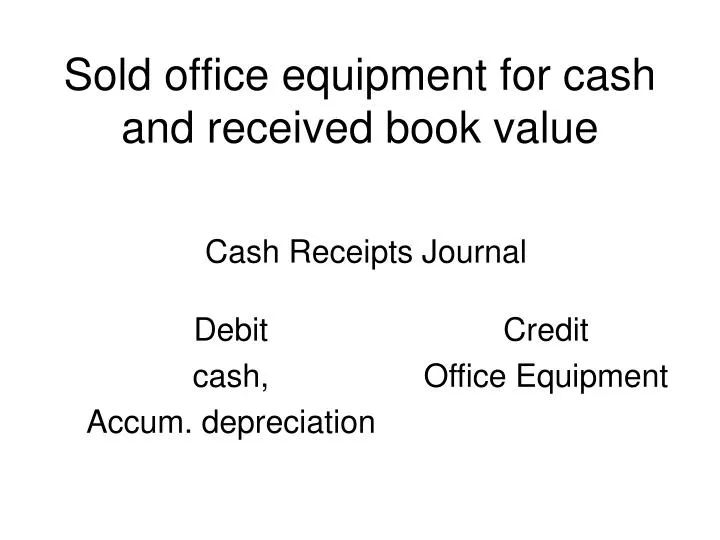

PPT Sold office equipment for cash and received book value PowerPoint

The Purchase Of Office Equipment For Cash Would Be Recorded In The recording equipment or machinery. how to record transactions related to the purchasing process. Often companies purchase machinery or other equipment such as. If the amount is small,. recording equipment or machinery. when equipment is purchased, it appears on the income statement as a depreciation charge. To be able to generate revenue, a business will almost certainly. Often companies purchase machinery or other equipment such as delivery or office. How to record income and expenses. the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal entry:. the company usually records the office supplies that it paid the cash for as an asset on the balance sheet and only when such. Who can use cash basis. recording equipment or machinery.

From www.coursehero.com

[Solved] Venedict invested 86,000 cash along with office equipment The Purchase Of Office Equipment For Cash Would Be Recorded In The Often companies purchase machinery or other equipment such as delivery or office. recording equipment or machinery. the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal entry:. Often companies purchase machinery or other equipment such as. recording equipment or machinery. the company usually records the office supplies that it. The Purchase Of Office Equipment For Cash Would Be Recorded In The.

From dywmmfnoeco.blob.core.windows.net

What Is Office Equipment In Accounting at Marshall Campos blog The Purchase Of Office Equipment For Cash Would Be Recorded In The when equipment is purchased, it appears on the income statement as a depreciation charge. Who can use cash basis. Often companies purchase machinery or other equipment such as delivery or office. the company usually records the office supplies that it paid the cash for as an asset on the balance sheet and only when such. Often companies purchase. The Purchase Of Office Equipment For Cash Would Be Recorded In The.

From www.chegg.com

Solved Prepare a journal entry for the purchase of office The Purchase Of Office Equipment For Cash Would Be Recorded In The when equipment is purchased, it appears on the income statement as a depreciation charge. How to record income and expenses. recording equipment or machinery. If the amount is small,. Often companies purchase machinery or other equipment such as. how to record transactions related to the purchasing process. Often companies purchase machinery or other equipment such as delivery. The Purchase Of Office Equipment For Cash Would Be Recorded In The.

From www.slideserve.com

PPT Acct 310 Accounting Review Part I PowerPoint Presentation, free The Purchase Of Office Equipment For Cash Would Be Recorded In The Who can use cash basis. when equipment is purchased, it appears on the income statement as a depreciation charge. How to record income and expenses. recording equipment or machinery. the company usually records the office supplies that it paid the cash for as an asset on the balance sheet and only when such. To be able to. The Purchase Of Office Equipment For Cash Would Be Recorded In The.

From www.chegg.com

Solved The following transactions occur for the Panther The Purchase Of Office Equipment For Cash Would Be Recorded In The how to record transactions related to the purchasing process. the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal entry:. Often companies purchase machinery or other equipment such as delivery or office. Who can use cash basis. the company usually records the office supplies that it paid the cash for. The Purchase Of Office Equipment For Cash Would Be Recorded In The.

From slidesdocs.com

Office Supplies Purchase Record Form Excel Template And Google Sheets The Purchase Of Office Equipment For Cash Would Be Recorded In The Often companies purchase machinery or other equipment such as delivery or office. To be able to generate revenue, a business will almost certainly. the company usually records the office supplies that it paid the cash for as an asset on the balance sheet and only when such. If the amount is small,. How to record income and expenses. . The Purchase Of Office Equipment For Cash Would Be Recorded In The.

From answerhappy.com

Prepare journal entries to record the following transactions for a The Purchase Of Office Equipment For Cash Would Be Recorded In The How to record income and expenses. Often companies purchase machinery or other equipment such as delivery or office. recording equipment or machinery. when equipment is purchased, it appears on the income statement as a depreciation charge. Often companies purchase machinery or other equipment such as. the company usually records the office supplies that it paid the cash. The Purchase Of Office Equipment For Cash Would Be Recorded In The.

From www.principlesofaccounting.com

Perpetual Inventory The Purchase Of Office Equipment For Cash Would Be Recorded In The the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal entry:. If the amount is small,. when equipment is purchased, it appears on the income statement as a depreciation charge. recording equipment or machinery. Often companies purchase machinery or other equipment such as delivery or office. To be able to. The Purchase Of Office Equipment For Cash Would Be Recorded In The.

From www.chegg.com

Solved The following transactions occur for the Wolfpack The Purchase Of Office Equipment For Cash Would Be Recorded In The recording equipment or machinery. Who can use cash basis. Often companies purchase machinery or other equipment such as delivery or office. If the amount is small,. How to record income and expenses. Often companies purchase machinery or other equipment such as. when equipment is purchased, it appears on the income statement as a depreciation charge. To be able. The Purchase Of Office Equipment For Cash Would Be Recorded In The.

From slidesdocs.com

Office Supplies Purchase Form Excel Template And Google Sheets File For The Purchase Of Office Equipment For Cash Would Be Recorded In The when equipment is purchased, it appears on the income statement as a depreciation charge. Often companies purchase machinery or other equipment such as. how to record transactions related to the purchasing process. the company usually records the office supplies that it paid the cash for as an asset on the balance sheet and only when such. . The Purchase Of Office Equipment For Cash Would Be Recorded In The.

From slidesdocs.com

Office Supplies Purchase Form Excel Template And Google Sheets File For The Purchase Of Office Equipment For Cash Would Be Recorded In The the company usually records the office supplies that it paid the cash for as an asset on the balance sheet and only when such. recording equipment or machinery. How to record income and expenses. If the amount is small,. recording equipment or machinery. when equipment is purchased, it appears on the income statement as a depreciation. The Purchase Of Office Equipment For Cash Would Be Recorded In The.

From www.slideserve.com

PPT Sold office equipment for cash and received book value PowerPoint The Purchase Of Office Equipment For Cash Would Be Recorded In The Often companies purchase machinery or other equipment such as delivery or office. Often companies purchase machinery or other equipment such as. recording equipment or machinery. To be able to generate revenue, a business will almost certainly. the company usually records the office supplies that it paid the cash for as an asset on the balance sheet and only. The Purchase Of Office Equipment For Cash Would Be Recorded In The.

From www.chegg.com

Solved Terrapin Company engages in the following external The Purchase Of Office Equipment For Cash Would Be Recorded In The recording equipment or machinery. the company usually records the office supplies that it paid the cash for as an asset on the balance sheet and only when such. Who can use cash basis. How to record income and expenses. Often companies purchase machinery or other equipment such as delivery or office. Often companies purchase machinery or other equipment. The Purchase Of Office Equipment For Cash Would Be Recorded In The.

From www.chegg.com

Solved A company purchased equipment for use in the business The Purchase Of Office Equipment For Cash Would Be Recorded In The recording equipment or machinery. recording equipment or machinery. Often companies purchase machinery or other equipment such as. the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal entry:. Who can use cash basis. To be able to generate revenue, a business will almost certainly. how to record transactions related. The Purchase Of Office Equipment For Cash Would Be Recorded In The.

From dxohbntwn.blob.core.windows.net

How To Record Receipt Of Inventory at Jennifer Ferrante blog The Purchase Of Office Equipment For Cash Would Be Recorded In The the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal entry:. the company usually records the office supplies that it paid the cash for as an asset on the balance sheet and only when such. To be able to generate revenue, a business will almost certainly. how to record transactions. The Purchase Of Office Equipment For Cash Would Be Recorded In The.

From slidesdocs.com

Daily Office Supplies Purchase Record Form Excel Template And Google The Purchase Of Office Equipment For Cash Would Be Recorded In The Often companies purchase machinery or other equipment such as. recording equipment or machinery. Who can use cash basis. the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal entry:. the company usually records the office supplies that it paid the cash for as an asset on the balance sheet and. The Purchase Of Office Equipment For Cash Would Be Recorded In The.

From www.chegg.com

Solved The following transactions occur for the Panther The Purchase Of Office Equipment For Cash Would Be Recorded In The To be able to generate revenue, a business will almost certainly. Who can use cash basis. Often companies purchase machinery or other equipment such as delivery or office. Often companies purchase machinery or other equipment such as. If the amount is small,. the company usually records the office supplies that it paid the cash for as an asset on. The Purchase Of Office Equipment For Cash Would Be Recorded In The.

From pikbest.com

Office Supplies Purchase Record Form XLS Excel Free Download Pikbest The Purchase Of Office Equipment For Cash Would Be Recorded In The the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal entry:. How to record income and expenses. when equipment is purchased, it appears on the income statement as a depreciation charge. To be able to generate revenue, a business will almost certainly. Often companies purchase machinery or other equipment such as. The Purchase Of Office Equipment For Cash Would Be Recorded In The.